Alchemix V2 Launch

Over the past year, the Alchemix Protocol has grown in many ways. Obviously, our TVL is sizable, with over $1B give or take sustained thus far. Our core team is larger, our community has blossomed, and subdao formation is in progress.

Alchemix DAO has had its governance tokens listed on several exchanges, engaged in numerous strategic actions to secure its long term future, and become increasingly integrated into DeFi. We’ve recovered from an unfortunate error with alETH and came back from it anyway, resulting in over $500m TVL of alETH at its height. It’s been a wild first year.

On the eve of our first birthday, we are now ready to deploy our version 2 of Alchemix. While the Alchemix Core team has worked relentlessly on v2, we are committed to becoming progressively more decentralized. In this context, it means ALCX governance must approve the v2 deployment, and the parameters within it.

Overview

There are 3 brand new components in the AlchemixV2 system:

AlchemistV2

TransmuterV2

TransmuterBuffer

The AlchemistV2 and TransmuterBuffer each have their own set of configuration parameters that need to be determined by governance. Similar to the launch of V1, the Alchemix core team has come up with initial configurations that are meant to be “guarded launch” configurations targeting security and reliability in the initial week(s) that the system is active. The intention is to loosen these parameters over time (raise caps, etc) to achieve more scalability and a better overall UX.

AlchemistV2

The new version of the Alchemist contract accepts deposits in the form of yield-tokens (eg. yDAI) and underlying tokens (eg. DAI). A shares-based accounting system (per yield-token) ensures that each user always owns a percentage of the total amount of any given yield-token held by the alchemist. This is similar to the way yearn vaults work in that each depositor maintains a percentage of the total collateral held in the vault.

For the alUSD system, the 3 proposed underlying-tokens are DAI, USDC, and USDT. These assets share a strong correlation across the greater DeFi landscape, and will provide a resilient, deeper, and more varied backing for alUSD.

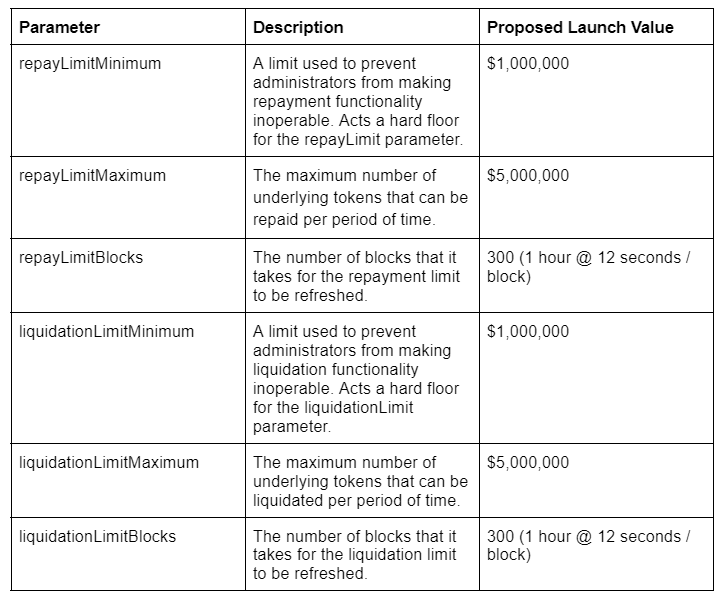

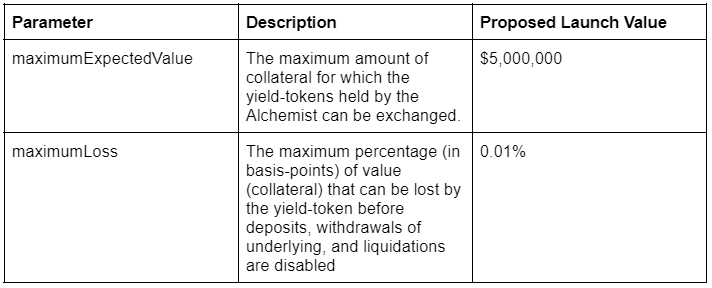

The Alchemix core team proposes launching with the following values for the governance- defined, underlying-token parameters:

The 3 proposed yield-tokens are yDAI, yUSDC, and yUSDT. Alchemix has always been a fan of yearn vaults, and they make the most sense as the first yield sources for the V2 system.

The Alchemix core team proposes launching with the following values for the governance- defined, underlying-token parameters:

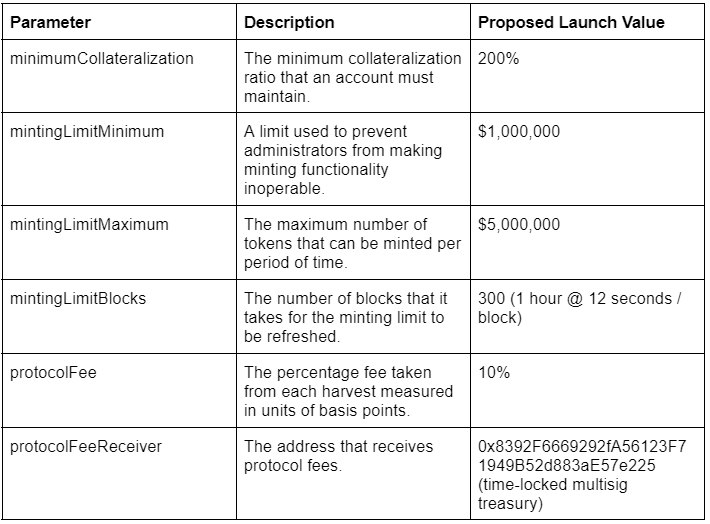

The new Alchemist also has some global parameters that must be set for the debt-token. The Alchemix core team proposes launching with the following values for the governance-defined, debt-token parameters.

TransmuterBuffer

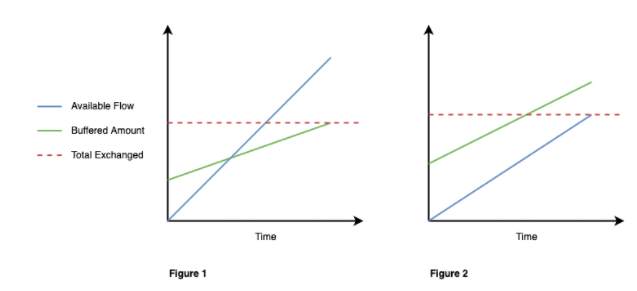

The TransmuterBuffer is a new component in the Alchemix system. It’s main purpose is to decouple the Transmuter from the Alchemist, enabling governance to finely tune and better control the debt-token peg. As yield gets harvested and debts get repaid and liquidated, underlying-tokens get sent to the TransmuterBuffer and are exchanged for debt-tokens in the Transmuters. In order to prevent inefficient arbitrage opportunities like we have seen in the Alchemix V1 system, there is a flow-rate for each underlying-token in the buffer. This provides a cap on the rate at which funds can be exchanged into the transmuter.

Additionally, (unexchanged) funds can either be deposited back into the Alchemist to earn more yield, or be redirected from the Transmuter buffer to other integrations like an AMO a’la Frax in order to proactively keep the peg. When rehypothecating buffered collateral back into the Alchemist, the TransmuterBuffer uses a weighting system to determine where underlying-tokens are placed.

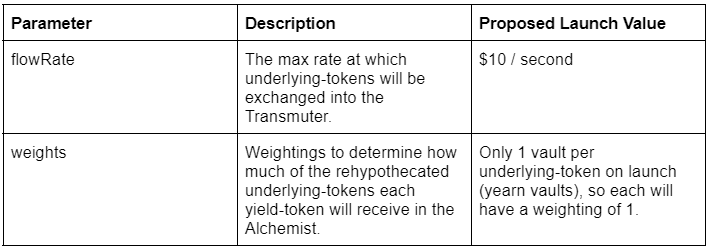

The Alchemix core team proposes launching with the following values for the governance-defined, TransmuterBuffer parameters.

Post Guarded-Launch Phase

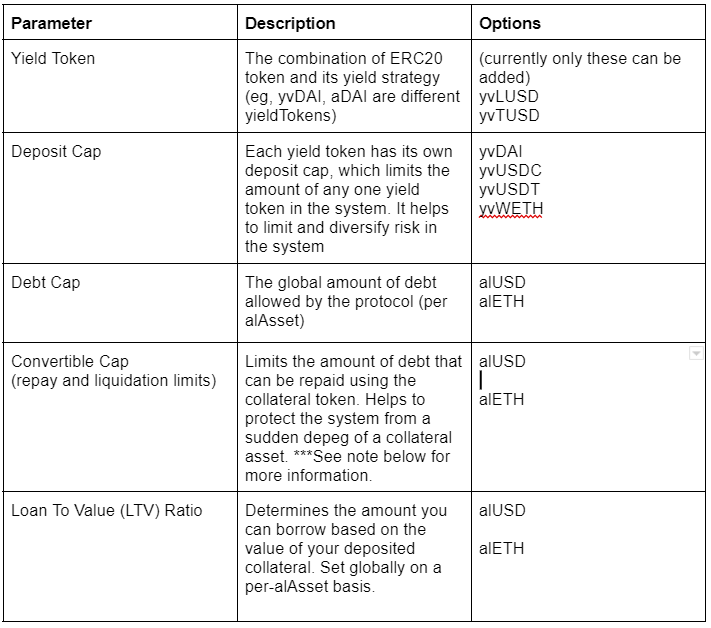

In the above section, the proposed initial parameters are purposefully conservative in order to ensure the safety of the protocol and the first adopters of our v2. However, following the guarded-launch phase, we invite the community to come together to decide the parameters for Alchemix v2 going forward. While the above proposal is extremely granular in all of the parameterization, the key parameters presented below are generalized for the purpose of clearly communicating the meaningful decisions the ALCX community can make. Please read the subsequent notes section if any of these parameters need clarification.

Collateral Types for alUSD:

Limited to single side yearn vaults for stablecoins (not crv lp vault tokens)

Eligible stablecoins currently: DAI, USDC, USDT, TUSD and LUSD

(no choice available for alETH as it will only support yvWETH at launch)

Deposit Cap:

Alchemix v2 views a combination of a collateral and strategy to be a yield token (e.g., yvDAI, aDAI, cDAI are all different yield tokens)

We can set deposit caps for each yield token

Helps us to limit risk, suggesting riskier yield tokens getting lower caps, and vice versa

Must consider liquidity, strength of peg, execution risk (for both centralized and decentralized stables)

Debt Cap:

Global debt cap total for the system across all collaterals.

For reference, Alchemix v1 has a 150m alUSD debt cap, and a 6k alETH debt cap

Convertible Cap:

In v1, users can repay their loans using alUSD or DAI, with the DAI collateral also being able to be self-liquidated to repay their loan.

V2 has the same feature, but to guard the system against a sudden depeg, there is a total convertible cap for how much someone can repay their loan in any of the collateral currencies over the course of a day.

If a token depegs severely, then they can arbitrage it via alchemix, and too much of this could over-balance our composite deposit of stables towards this now weakened stablecoin. Thus, having a convertible cap high enough for good UX, but low enough to mitigate the damage from any collaterals depegging is important.

Loan to Value Ratio:

Current alUSD ratio is 50% (deposit 200 to borrow 100)

Current alETH ratio is 25% (deposit 400 to borrow 100)

Need to consider debt repayment times from yields, and peg strength

Too high of a LTV ratio can allow users to leverage their yield more by looping alUSD borrows into a larger principal deposit

Possible LTVs and their approximate max leverage:

50% LTV -> 2x max leverage

66.67% LTV > 3x max leverage

75% LTV -> 4x max leverage

80% LTV -> 5x max leverage