TL;DR

Set a treasury of $500k via multisig controlled by the core team to be able to buy strategic illiquid assets to avoid front-running by third parties. Once a purchase is done, a snapshot vote is set up to determine if the newly acquired funds should be kept or sold. If funds are kept, the strategic acquisition fund is refilled.

Proposal

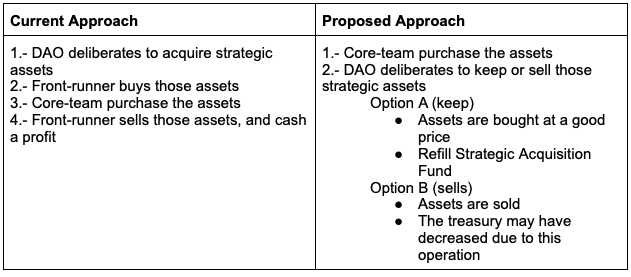

A common problem in a DAO, which are decentralized and transparent, is front-running when deciding to buy a shadowed asset with not much liquidity. The problem arises as a third party can front-run the DAO to acquire a strategic asset due to the long-term deliberation that a DAO has to decide. The DAO needs some time to discuss, prepare a proposal and pass a vote.

Some DAOs have overcome this issue by using devs funds to temporarily buy such assets in the hopes the community will approve it (e.g., Silo Finance acquiring CVX using devs funds). Another example was done by the core team of Alchemix that acquired StakeDAO using internal funds. However, this process does not follow the ethos of decentralization and transparency.

This proposal seeks to overcome this by delaying the approval of the community after the funds have been secured by the core team.

Please, notice that the core-team needs to have an agreement between them to be able to purchase the assets as there is a multisig. So, it is a collective decision of the core team, that is later ratified by the DAO.

Conditions

- Allow the core team & governance team to market buy up $500k of an illiquid asset that they consider beneficial for the DAO.

- An illiquid asset is determined at the discretion of the core team based on whatever an asset has not deep enough liquidity. If there was enough liquidity, the standard approach should be pursued (i.e., ask the community for approval, then purchase the asset).

- Additionally, OTC swaps should be pursued with other DAOs before considering the market the use of these strategic funds.

- After each purchase, the core team/governance team will update the community on the actions taken. Then, a vote will take place to determine if the funds are kept or market sold.

- If the vote is kept the treasury funds for the Strategic Fund for Acquiring Assets should be increased to the maximum quantity (i.e., refill the fund).

- The approval to market buy assets will remain valid until a governance vote changes this.

- The Strategic fund is not a vehicle for speculation. The purpose of these acquisitions is not to engage in active or swing trading.

- This strategic fund for acquiring illiquid assets is a virtual wallet to minimize idle funds (i.e., $500k will be the max available, however, these balances can be distributed in multiple wallets)

Relevant contract addresses

- Alchemix treasury: 0x8392F6669292fA56123F71949B52d883aE57e225

- Alchemix dev multisig: 0x9e2b6378ee8ad2A4A95Fe481d63CAba8FB0EBBF9

Risks

The main risk identified for this proposal is that the acquisition purchase is done to increase the price of an asset that benefits the team responsible for the purchase, that is not aligned with Alchemix.

This risk is mitigated by the following points:

- The decision is done by multiple wallets from the core-dev

- The objective of the acquisition should be for acquiring assets with not much deep liquidity, so there are fewer assets available

- The downside is limited to the treasury in this wallet. Furthermore, the assets can be sold at market price

Vote

Allow the core team/governance team to autonomously deploy capital when they see an opportunity in the market to buy strategic assets.

Please let us know your thoughts on this proposal. If the community is receptive to this set-up we will move to an official AIP with a simple yes/no vote.