Summary

This proposal outlines a series of changes to emissions and revenue generation that aim to make Alchemix more sustainable in the short term while preserving the ability to scale. The two proposed changes, to be voted on with multiple choice are:

- Pause Olympus Pro Bonds

- Sell TOKE farmed from the treasury-owned 69,420 ALCX position for CRV (this does not affect TOKE farmed from the tALCX staking pool).

Motivation

While the aim of Alchemix is to provide a stable long term loan product, there are many under-the-hood aspects of Alchemix that are regularly re-evaluated to maintain the product, such as the allocation of ALCX emissions and the utilization of treasury assets. Adjustments to these parameters will allow us to continue to deliver the best version of the product, and should be evaluated periodically. The purpose of this proposal is to make initial emissions/revenue changes that are considered to be less contentious and easy to enact, as part of a larger process to overhaul emissions allocations for the purpose of lowering the quantity of ALCX that enters circulation, while still allowing the protocol the means to continue to scale.

The motivation behind this approach is based on the diminished usefulness of incentivized revenue. In a bull market as well as in the beginnings of any protocol, incentivized revenue (most commonly, giving away protocol tokens to speed up the growth and adoption of the protocol) is a valid approach. This strategy has allowed Alchemix to build up a significant user base and treasury. This is a short term sacrifice of token price to ensure a greater chance at long term success. However, the price action of ALCX, DeFi, and Crypto in general over the last year is showing that the returns on selling ALCX emissions for treasury assets and rented liquidity are diminishing - to the point where we may be better off holding those tokens long term in the DAO treasury. Therefore, incentivized revenue should be scaled back when operating in a manner that creates continued downward pressure on ALCX price when there is an absence of upward pressure from outside sources.

This proposal is not meant to be the only forthcoming change to ALCX tokenomics; additional changes that will require development time before inclusion into the future DAO model were revealed on the May 13th fireside and are forthcoming in a future AIP. This proposal is the first of several that will look to restructure Alchemix emissions, revenue, and tokenomics.

Looking Ahead

There are other emissions/revenue related levers that are under scrutiny. However, recent market conditions have led to significant amounts of change within DeFi. Emissions adjustments also often have unintended consequences. These are the potential changes being considered in future proposals:

Evaluate CVX and CRV bribes and continue to adjust our positioning and strategy accordingly, including pursuing long term alignment with individuals and DAOs with large CVX/CRV holdings.

Adjust AMO boosted yield distribution (would be a stopgap for the new tokenomics)

Adjust the base fee (currently 10%)

Additional projects for Alchemix treasury/revenue/protocol transparency include the recently released Quarterly Report as well as Alchemix-Stats.com, which is in continuous development internally and supplemented with a partnership with Multifarm (who built the Olympus dashboard)

Proposed Modifications

Pause All Olympus Pro Bonds

Olympus Pro bonds are a nuanced way of selling ALCX for strategic treasury assets, with the primary benefit being that purchasing ALCX through a bond requires some level of belief in the asset (due to the lockup). Therefore, believers of ALCX are benefiting from the emissions, rather than mercenary farmers. That being said, the predominant bond strategy is to continuously loop bonds in order to accumulate ALCX at a faster rate than the single stake options. This benefits a small subset of the community that participates in bonding, but it means that most, if not all of the emissions allocated to bonding are being dumped into the ALCX/ETH SLP pool. It also obviously benefits the DAO. But it harms ALCX holders that don’t participate in bonding.

It is apparent that there is not currently enough positive pressure on ALCX to offset this downward pressure. This has created a situation where ALCX price depreciation - especially relative to CVX over the same time period - means that each additional ALCX emitted via Olympus Pro bonds yields relatively fewer assets in return. A consensus is now emerging that these ALCX emissions are better redirected to the Alchemix treasury, such that they may instead be used in future when broader market conditions improve (ie, until expected future value of bonding > current value of ALCX).

Proposal: Pause Olympus Pro Bonds, Send those ALCX Emissions to DAO

Sell Treasury-owned tALCX TOKE farming gains for CRV (not TOKE from the tALCX pool)

Alchemix currently pays more than double the APR to tALCX stakers in order to earn their TOKE. This is somewhat acceptable, because the ALCX paid is not usually sold on the market, so we get TOKE in exchange for ALCX that has a longer investment time horizon. However, Tokemak has been understandably taking a conservative roll out approach and we are well-positioned to maintain a top spot amongst DAOs.

The tALCX pool needs to remain, for the token sink reasons mentioned above as well as keeping Alchemix well positioned to take advantage of Tokemak in the future by farming TOKE from tALCX that stakers lock up. Separately, the TOKE accumulated by the 69,420 ALCX the DAO has staked in Tokemak is paying out at 11% APR. At current low ALCX prices, and given we already have a large TOKE share and continue to accumulate quickly via the tALCX pool, we should consider selling the TOKE from DAO farming for ALCX (to offset emissions) or CRV (to continue scaling).

At present, CRV is currently the most productive way to create lasting liquidity to help scale ALchemix to the greatest number of possible users - see AIP 46. We envision that in the long-term, TOKE will be an even more effective layer on top of Curve and other AMMs. However, the DAO currently accumulates more value in TOKE than CRV, despite CRV being the more immediate need due to its use case for alAsset liquidity (which TOKE doesn’t yet cover). This proposal is simply a small shift in that accumulation balance. The rate and method of accumulation of all treasury assets should be under continuous evaluation and can change in the future.

While ALCX buybacks may help offset the sell pressure, the Bizgov subDAO believes that the Olympus Pro pause should have a significant enough initial effect on emissions that the TOKE can be used to purchase CRV. Additionally, if Olympus Pro leads to a higher relative ALCX valuation, then this should lead to more TOKE emissions captured by the Alchemix staking position. Note, at 69,420 ALCX at 11% APR is about 150 ALCX/week or 1.5% of weekly emissions use to purchase CRV. We do recognize that Tokemak, like Alchemix, is feeling the pain of a heavy emissions schedule in a downward market trend, but the amount of TOKE being sold here is small relative to the market cap of TOKE and the amount of TOKE being accumulated weekly by Alchemix.

Proposal: Sell TOKE rewards from the ALCX the DAO stakes in Tokemak, use the proceeds to purchase CRV, and continue to accumulate and hold our large stake in TOKE through the incentivization of the tALCX pool (see below)

Keep tALCX, ALCX/ETH SLP, and gALCX emissions the same

Incentivized ALCX Holding, ie giving away ALCX to ALCX holders does somewhat limited damage relative to other emissions - it is the primary mechanism by which the dilution of ALCX holders is offset, so only those holding unstaked ALCX are facing the full brunt of the dilution. So while it can be considered a cost, it also has a difficult-to-quantify benefit of making the act of holding ALCX less dilutive. Eventually this benefit will be outweighed by the cost as emissions can be better used to continue scaling Alchemix. Continuing the gALCX and tALCX pools is the primary tool by which ALCX can be sustainably held while the DAO continues to work to reduce the quantity of ALCX emissions necessary to send to mercenary capital.

ALCX/ETH SLP does not yet have good alternatives (Tokemak is promising but is understandably not yet operating at full capacity), and the TVL of the pool has eroded with price. While ALCX/ETH emissions are also often dumped, depositors also act as exit liquidity for mercenary capital that dumps, and therefore need to be rewarded accordingly. The pausing of Olympus Pro bonds, and the redirection of those ALCX emissions to the DAO should reduce some of the sell pressure on ALCX/ETH LPers and therefore making LPing more attractive, however the elimination of bonds will result in more users looking to stake in the ALCX/ETH LP pool (thus reducing the APR), among the other pools. There are plenty of arguments to be made for and against adjusting these emissions, but emissions adjustments can often have unintended consequences. For this reason, these emissions will remain the same in this proposal with the intent to re-evaluate again in the short term once the changes within this proposal go live.

No Proposal - we recommend re-evaluating tALCX, ALCX/ETH SLP, and gALCX emissions after the other items in this proposal take effect.

Summary of Proposed Emissions Adjustments

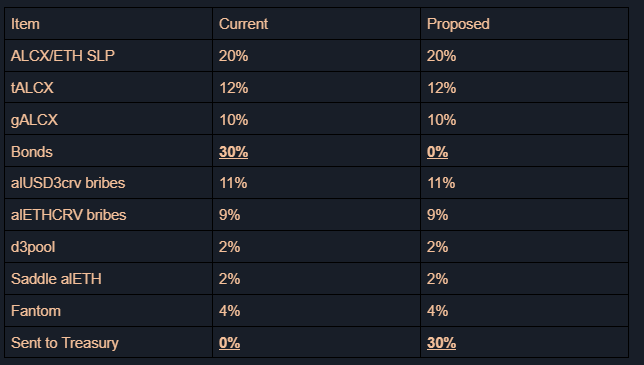

Note that only the first item in this proposal is a direct adjustment to emissions. Below is a summary of emissions as they stand, with the proposed Olympus Pro pause to send those emissions to the treasury:

Voting

Voting is multiple choice. Vote for all options you wish to be enacted. The result of a failure for each item to pass is indicated in parentheses.

- Pause Olympus Pro Bonds and send 30% of ALCX emissions to the DAO treasury. (Failure to pass means Olympus Pro continues at the current rate)

- Sell TOKE farming gains from DAO-owned ALCX for CRV (Failure to pass indicates the DAO will continue to keep farmed TOKE)