Introduction

AIP-36 identified the need to determine launch values for the following configuration items for each of the Alchemix vaults:

- Accepted collateral types for each vault.

- For each alAsset:

- Mint cap

- Maximum Loan-to-Value (LTV) ratio for each alAsset

- For each collateral type:

- Repayment cap

- Liquidation cap

- For each yield token (i.e. yvTokens):

- Maximum expected value (aka Deposit Cap)

- Maximum loss

This AIP will run through each of these items for the alETH vault and will provide a proposal and justification for the configuration of each. For an explanation of these items, refer to the official Alchemist v2 Risk Management documentation.

In addition, this AIP identifies a strategy for supporting an orderly migration from the v1 alETH vaults.

TLDR

- Approve the following Alchemix v2 alETH post-guarded launch parameters:

- Accepted collateral types:

- Ether, WETH

- Yearn yvWETH

- Lido stETH

- RocketPool rETH

Note stETH and rETH may not be available immediately after the unguarded launch. This proposal authorises the stETH launch when ready.

- alETH maximum Loan-to-Value (LTV) ratio: 50%

- Deposit Caps:

- yvWETH: 8,000

- stETH: 100

- rETH: 25

- Maximum Loss:

- yvWETH: 5 bps (0.05%)

- stETH: 5 bps (0.05%)

- rETH: 5 bps (0.05%)

- Repayment Cap:

- ETH: infinite per 10 minutes

- Liquidation Cap:

- ETH: infinite per 10 minutes

AND,

- Request the Alchemix MultiSig signatories to act as follows:

- When at least 1,000 alETH is mintable via Alchemix v1, reduce the Alchemix v1 alETH Debt Cap to the nearest whole multiple of 1,000 alETH.

- When the yvWETH Deposit Cap is below 40,000 AND the Deposit Cap utilisation is at or above 95% AND the alETH:ETH peg has been at or above 0.998 for the past 48 hours, then increase the yvWETH Deposit Cap by 4,000 ETH.

- When the stETH Deposit Cap is below 2,000 AND the deposit cap utilisation is at or above 95% AND the alETH:ETH peg has been at or above 0.998 for the past 48 hours, then double the stETH Deposit Cap, at a maximum rate of once per week.

- When the rETH Deposit Cap is below 400 AND the deposit cap utilisation is at or above 60% AND the alETH:ETH peg has been at or above 0.998 for the past 48 hours, then double the rETH Deposit Cap, at a maximum rate of once per week.

Execution

It is left to the Alchemix core team and multisig signatories to enact this increase at their discretion.

Details & Justifications

Accepted Collateral Types

The Alchemix v2 alETH vault is presently capable of accepting the following collateral types:

Yearn ywWETH is currently the only yield-bearing token accepted and is mandatory for alETH vault operation; ETH and WETH are accepted for user-convenience.

Additionally, the core team has announced that alETH will soon support yield strategies for the following liquid staking tokens:

- Lido stETH

- RocketPool rETH

These strategies will be made available as part of a limited rollout.

Note: Ether is automatically wrapped to WETH on deposit via the v2 WETHGateway.

Proposal

Accept Ether, WETH, yvWETH, stETH, and rETH as collateral types in Alchemix v2.

alAssets

Maximum LTV

The Alchemix v1 alETH maximum LTV has been fixed at 25% as part of AIP-10. Almost 9 months has since passed; the alETH peg has since proven to be quite stable and there is broad demand for a higher max LTV. See Comparison to alUSD in the supplementary section at the bottom of this proposal.

Proposal

Maintain the Alchemix v2 Guarded Launch alETH maximum LTV at 50%.

For clarity, no change to the Alchemix v1 alETH LTV is proposed as part of this AIP.

Justification

There is a high degree of confidence in Alchemix’s ability to sustain a maximum LTV of 50% based on historical alETH performance and the comparatively low alETH Deposit Cap.

Benefits

An alETH LTV of 50% will broaden the appeal of the alETH vault:

- Broaden the appeal of alETH loans through better capital efficiency.

- Enable users who are max-borrowed at 25% LTV on Alchemix v1 to self-liquidate and migrate to Alchemix v2. Users would not only be able to fully migrate their v1 collateral to v2, but also borrow an additional 12.5%.

Risks

- Transitioning to 50% increases the marginal benefit from each loop in recursive borrowing scenarios, and permits maximum potential leverage of 2x (up from 1.5x @ 25% LTV).

For example, with 25% LTV, a user needs to deposit 2 ETH into Alchemix in order to remove 1 ETH of liquidity via recursive borrowing (i.e. by selling 1 alETH). With 50% LTV, a user depositing 2 ETH can use the same strategy to remove 2 ETH of liquidity. This means less overall capital is required to impact the liquidity pools, but the presence of the debt cap means the peg stress cannot exceed what would otherwise occur from hitting the debt cap organically (i.e. without all users recursive borrowing). Effectively with 50% LTV a user can cause the same amount of peg stress with only half of the capital compared to 25% LTV.

- Mitigating factors:

- The alETH Deposit Caps are set conservatively as part of this proposal, thereby preventing runaway recursive borrowing.

- In the unlikely worst case of sustained alETH peg instability, Alchemix retains the option of redirecting ALCX emissions from other emissions sinks in order to shore up alETH peg stability (as occurred recently in AIP-34).

Yield Tokens

Maximum Expected Value (Deposit Cap)

The Deposit Cap controls the maximum accepted TVL for each yield token. Per this proposal, this includes yvWETH, stETH, and rETH.

Note:

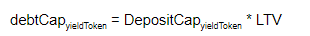

Alchemix v1 has an global Debt Cap per alAsset, which can be explicitly set. In Alchemix v2, the Debt Cap is indirectly determined per yield token according to the following equation:

With the LTV is fixed at 50%, the Deposit Caps for each yield token combine to set the effective Debt Cap for each alAsset. With yvWETH as the exclusive yield token, the alETH debt cap is implicitly controlled via the yvWETH deposit cap.

AIP-27 authorises a maximum Alchemix v1 alETH Debt Cap of 10,000 alETH. Outstanding debt currently sits at 6,200 alETH (see hasMinted()). This implies that there is 3,800 alETH that can be reallocated to Alchemix v2 in order to increase its Deposit Cap with no net impact on total global alETH debt. This available quantity should be taken into consideration when setting yield token Deposit Caps.

yvWETH

Assuming an LTV of 50%, the Deposit Cap for yvWETH should be set to debtCapdesired / LTV. Per above, this corresponds to a value of 4,000 / 50% = 8,000 yvWETH.

stETH + rETH

stETH and rETH will be ready for launch soon after the v2 unguarded launch. The intent is to test both out with small deposit caps, and then ramp them up as it becomes apparent that they are safe.

Proposal

- Request the core team to act as follows:

- Set the initial Post-Guarded Launch yvWETH Deposit Cap to 8,000, AND

- When at least 1,000 alETH is mintable via Alchemix v1, reduce the Alchemix v1 alETH Debt Cap to the nearest whole multiple of 1,000 alETH.

- When the current yvWETH Deposit Cap is below 40,000 ETH AND the deposit cap utilisation is at or above 95% AND the alETH :ETH peg has been at or above 0.998 for the past 48 hours, then increase the yvWETH Deposit Cap by 4,000 ETH.

- When the current stETH Deposit Cap is below 2,000 ETH AND the deposit cap utilisation is at or above 95% AND the alETH :ETH peg has been at or above 0.998 for the past 48 hours, then double the stETH Deposit Cap, at a maximum rate of once per week.

- When the rETH Deposit Cap is below 400 AND the deposit cap utilisation is at or above 60% AND the alETH:ETH peg has been at or above 0.998 for the past 48 hours, then double the rETH Deposit Cap, at a maximum rate of once per week.

Justification

This strategy permits v1 usage to decay naturally, whilst eliminating unexpected future minting of alETH via Alchemix v1, and enabling v2 to scale up somewhat independently of v1 if the peg is strong.

For example: v1 currently has 1,800 alETH mintable at 8,000 alETH debt cap. This proposal would authorise a v1 Debt Cap reduction to 7,000 alETH and a v2 Deposit Cap increase of 4,000 yvwETH (to 12,000 yvwETH), assuming peg is strong. The result is a net alETH Debt Cap increase of 1,000 ETH (10%).

This strategy also enables the stETH and rETH strategies to scale up to reasonable deposit caps in the same timeframe as the 6 week transmuter migration.

Maximum Loss

This is a variable that disables certain actions such as the ability to deposit in the vault in the event that the yield source is losing money. This should ideally never come into play but serves as a safeguard in the event of a problem with an integrated yield source. Basis points are measured as hundredths of 1%. See the description in the Alchemix v2 documentation for more information.

Proposal

For each of the accepted yield-bearing tokens, set the Maximum Loss to 5 basis points (bps).

Justification

The core team recommends that Maximum Loss is set between 1 - 10 bps.

Collateral Caps

Repayment Cap + Liquidation Cap

Due to the arbitrage inherent to the Alchemix V2 system, it is important to have stop-gap measures in place to prevent massive capital movements that could harm the backing of synthetic assets. That’s what these variables refer to. They are not global limits in the system, but are time based limits.

- Repayment Cap - The quantity of debt that can be repaid over a set duration of time. It could specify for example that “10k ETH can be repaid every 10 minutes”.

- Liquidation Cap - The quantity of an asset that can be liquidated over a set duration of time. It could specify for example that “10k ETH can be liquidated every 10 minutes”

Proposal

Set the ETH/WETH Repayment and Liquidation Caps at infinite per 10 minutes.

Justification

Collateral Caps are mostly relevant for assets that are designed to be stably pegged to another asset. ETH is not subject to the same risks as USD stables because it is a highly trusted, standalone asset with a floating price. Therefore, the cap is set as infinite so as to prevent unnecessary limiting of liquidations and repayments.

Supplementary Information

alETH Peg Stability

Historical Performance

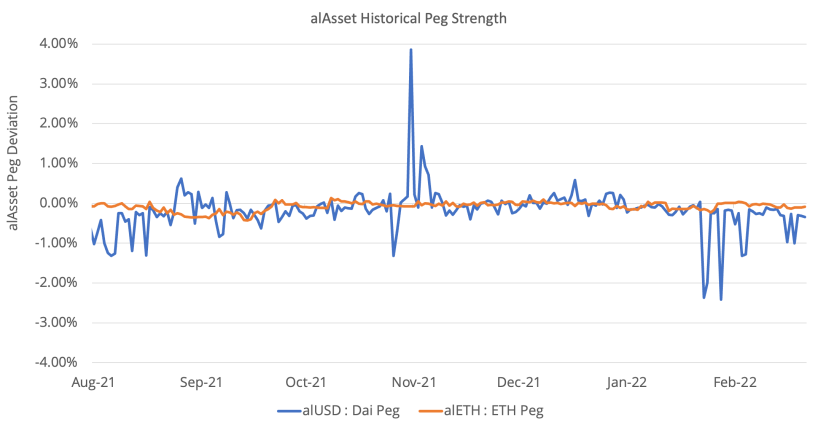

Chart from Messari - from dune queries for daily alETH and alUSD prices

Historically alETh has remained closer to peg than alUSD. This is due to a combination of a deep liquidity pool and a low debt cap. The data shows that there should be plenty of wiggle room with a larger effective debt cap (deposit cap times LTV) in V2.

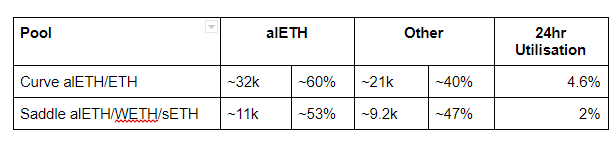

Current Liquidity Depth

The two major alETH liquidity pools are currently composed as follows (as at 2022-03-17):

alETH Comparison to alUSD

alETH Comparison to alUSD

alUSD has demonstrated stability at 50% LTV since inception. alETH has maintained very similar liquidity parameters as alUSD, implying it could support the same debt cap and LTV parameters as alUSD. For comparison:

- The alUSD pool has a TVL of $186M, compared to the alETH pool TVL of $146m, plus additional TVL in Saddle.

- Both the alUSD and the alETH pool are currently slightly overweight on the al-assets (60%/40%).

- alUSD a-factor is 200, compared to alETH a factor of 100.

- DAI yield on Yearn is 1.48%, compared to the ETH yield of 1.32%.

This data indicates that aside from the debt cap and LTV ratio, alUSD and alETH are very similar products. This implies that alETH could support a similar debt cap and the same LTV as alUSD. This proposal authorises a stepped increase up to a maximum of about a $50m alETH effective debt cap, which is ¼ of that of alUSD.

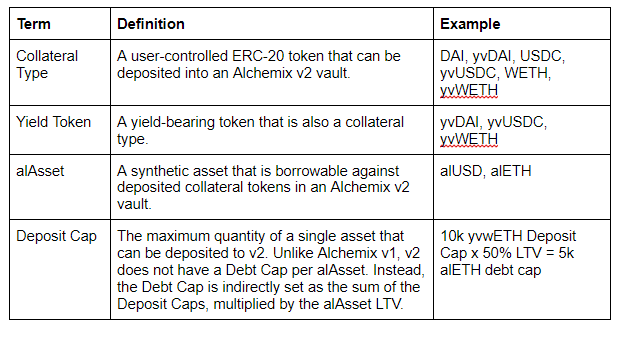

Glossary

This AIP must use some specific terminology to correctly identify the configuration items in the Alchemix v2 implementation.