Proposal

Approve the following Alchemix v2 alUSD post-guarded launch parameters:

- Accepted collateral types:

- DAI, USDC, USDT, LUSD

- yvDAI, yvUSDC, yvUSDT, yvLUSD

- alUSD maximum Loan-to-Value (LTV) ratio: 50%

- Deposit Caps:

- DAI = $20 million

- USDC =$20 million

- USDT = $20 million

- LUSD = $2 million

- Repayment and Liquidation Caps:

- DAI = $10 million per 60 minutes

- USDC = $10 million per 60 minutes

- USDT = $10 million per 60 minutes

- LUSD = $1 million per 60 minutes

- Maximum Loss:

- DAI = 5 bps (0.05%)

- USDC = 5 bps (0.05%)

- USDT = 5 bps (0.05%)

- LUSD = 5 bps (0.05%)

AND,

- Request the Alchemix MultiSig signatories to act as follows:

- When at least $10m alUSD is mintable via Alchemix v1, reduce the Alchemix v1 Debt Cap to the nearest whole multiple of $10m alUSD, AND

- When any of the individual current DAI, USDC, and USDT Deposit Caps are below $100 million, AND the deposit cap utilisation of DAI, USDC, USDT is at or at or above 95%, AND the alUSD:3CRV peg has been at or above 0.996 for the past 48 hours, then increase the Deposit Cap of all assets with 95%+ utilisation by $20m total (distributed evenly to each asset), AND

- When the LUSD Deposit Cap is below $10 million, AND the deposit cap utilisation of LUSD is at or above 95%, AND the alUSD:3CRV peg has been at or above 0.996 for the past 48 hours, then increase the Deposit cap of LUSD by $2m LUSD.

Execution

It is left to the Alchemix core team and multisig signatories to enact the increases at their discretion.

Introduction

See the Introduction to the alETH proposal here for context.

Accepted Collateral Types

The Alchemix v2 alUSD vault is presently capable of accepting the following collateral types:

- DAI / yvDAI

- USDC / yvUSDC

- USDT / yvUSDT

The core team believes the Alchemix v2 alUSD vault should also accept the following collateral type:

Proposal

Accept all of the above collateral types in v2.

Benefits

DAI is already accepted by v1 and will remain to do so. USDC and USDT complete the trifecta of the highest TVL vaults on yearn. LUSD is a fully trustless stablecoin with strong pegging mechanisms and high yields on yearn.

Risks

The primary risk for any accepted stablecoin is a depegging event, whether through centralization risks or decentralised system failure. DAI and LUSD are pegged through liquidations, while USDT and USDC are pegged with centralised backing. See “Repayment + Liquidation Caps” section below for an explanation of the risks to alchemix if a stablecoin were to depeg.

alAssets

Maximum LTV

The Alchemix v1 alUSD maximum LTV has been fixed at 50% since launch. V2 has been launched with 50% LTV. This proposal keeps alUSD vaults at 50% LTV.

Yield Tokens

Maximum Expected Value (Deposit Cap)

The Deposit Cap controls the maximum accepted TVL for each yield token. Per this proposal, alUSD can be borrowed against multiple yield tokens.

Note:

Alchemix v1 has a global Debt Cap per alAsset, which can be explicitly set. In Alchemix v2, the Debt Cap is determined per yield token according to the following equation:

Therefore, the Deposit Caps for each yield token combine to set the effective Debt Cap for each alAsset. In the case of alUSD, this is:

As at 2022-03-XX, the Alchemix v1 alUSD debt cap sits at $150m alUSD (see ceiling()). Outstanding debt currently sits at ~$61m alUSD (see hasMinted()), meaning there is ~$80m alUSD headroom before maxing out.

USDT, DAI, USDC, and LUSD Deposit caps

Proposal

Request the core team to act as follows:

- Set the initial Post-Guarded Launch USDT, DAI, and USDC deposit caps to $20m, and set the LUSD deposit cap to $2m.

- When at least $10m alUSD is mintable via Alchemix v1, reduce the Alchemix v1 Debt Cap to the nearest whole multiple of $10m alUSD, AND

- When any of the individual current DAI, USDC, and USDT Deposit Caps are below $100 million, AND the deposit cap utilisation of DAI, USDC, USDT is at or at or above 95%, AND the alUSD:3CRV peg has been at or above 0.996 for the past 48 hours, then increase the Deposit Cap of all assets with 95%+ utilisation by $20m total (distributed evenly to each asset), AND

- When the LUSD Deposit Cap is below $10 million, AND the deposit cap utilisation of LUSD is at or above 95%, AND the alUSD:3CRV peg has been at or above 0.996 for the past 48 hours, then increase the Deposit cap of LUSD by $2m LUSD.

Justification

Given the alUSD debt cap is currently large, and has not been minted fully against, the intent of this proposal is to keep the same global debt cap (v1 and v2 combined), while shifting debt cap away from v1 and into v2 (in the form of a higher v2 deposit cap).

Because the global alUSD cap is not expanding, the v1->v2 migration will be net neutral for the transmuter (self liquidations in v1 boost transmuter TVL, while new loans in v2 cause peg stress and therefore transmuter drainage). The fact that the overall alUSD debt will not increase is why the peg requirement of 0.996 is used as a qualifier for debt cap migration, instead of the typical 0.998 that was used in the alETH proposal. However, a minimum peg is still in place so as to give the transmuter and peg time to rebalance with each shift..

Benefits

By allowing the deposit caps to grow naturally by asset, we can make sure that v1 debt cap is being repurposed to the most in-demand assets.

Risks

In theory, if one asset is more in demand than the rest, it could scale to become an outsized portion of the Alchemist / Transmuter TVL. This can present a risk to the peg and backing of alUSD through the arbitrage loop explained below. Based on current yearn vault TVLs, it could be expected that USDC and DAI will be the fastest vaults to scale. Additionally, each asset is set to a cap of $150m meaning they are limited in how much they can scale relative to the other assets.

Collateral Caps

Repayment Cap + Liquidation Cap

If any underlying asset (USDT,USDC,DAI,ETH) depegs, Alchemix creates a major arbitrage opportunity at the cost of the diversified backing of the alAsset and the peg. For example, if USDT depegs, arbitrageurs can purchase USDT for cheap, deposit to Alchemix, take a loan for alUSD, sell that for more cheap USDT (which will then begin to depeg alUSD), deposit more USDT, take a new alUSD loan, etc, and keep looping until they’ve created a huge USDT position within Alchemix for a fraction of the cost. They can then self liquidate their position or repay the loan with cheap USDT. Additionally, any users with USDT positions and outstanding debt can pay it back with cheap USDT. All of these actions greatly shift the alUSD backing towards the depegged USDT while also depegging alUSD.

The scenario above creates the need to place a cap on how much of each underlying asset can be used to Repay debt or Liquidate debt.

Proposal

Set the alUSD Repayment and Liquidation Caps as follows:

- DAI = $10m per 60 minutes

- USDC = $10m per 60 minutes

- USDT = $10m per 60 minutes

- LUSD = $1m per 60 minutes

Justification

These caps would allow for $10m of capital to flow through an arbitrage loop each 60 minutes. Any single Alchemix core team member on the multisig can pause the Alchemix v2 vaults. An hour is a reasonable response time for one of many to recognize that a stablecoin is depegging and Alchemix is being used for arbitrage. In that one hour, only $20m of a depegged stablecoin could pass through alchemix ($10m hour 0, $10m when hour 1 starts), which would be a noticeable but ultimately absorbable arbitrage (especially relative to the damage that would be caused to DeFi as a whole).

Supplementary Information

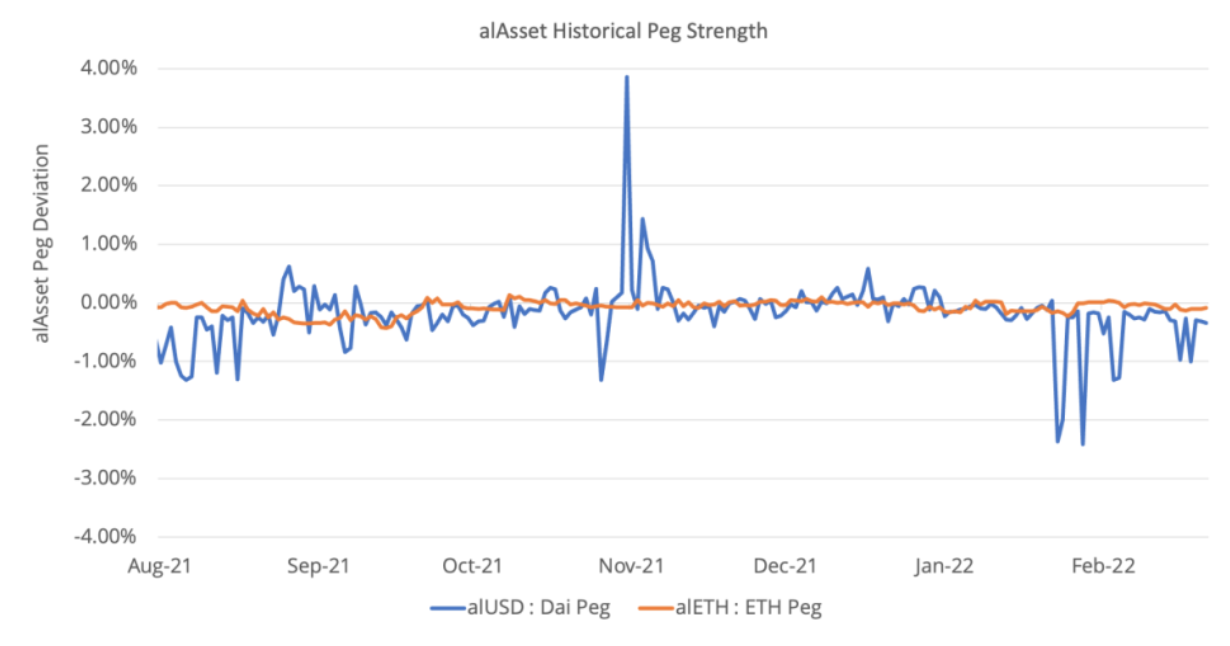

alUSD Peg Stability

Historical Performance

alUSD has remained largely on peg, though not as tightly as alETH. Additionally, historically the alUSD debt cap has not been maxed out. For these reasons, the global alUSD deposit/debt cap (ie, the maximum debt allowed in v1 and v2 combined) is being kept approximately the same.

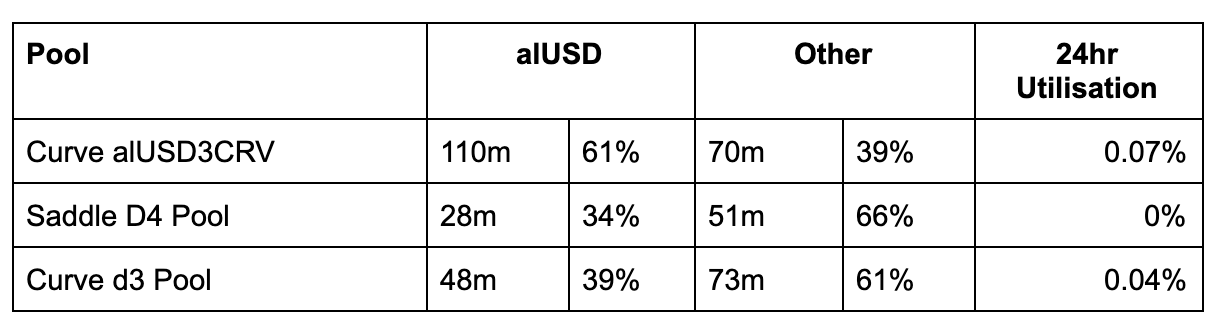

Current Liquidity Depth

The two major alUSD liquidity pools are currently composed as follows (as at 2022-03-25):

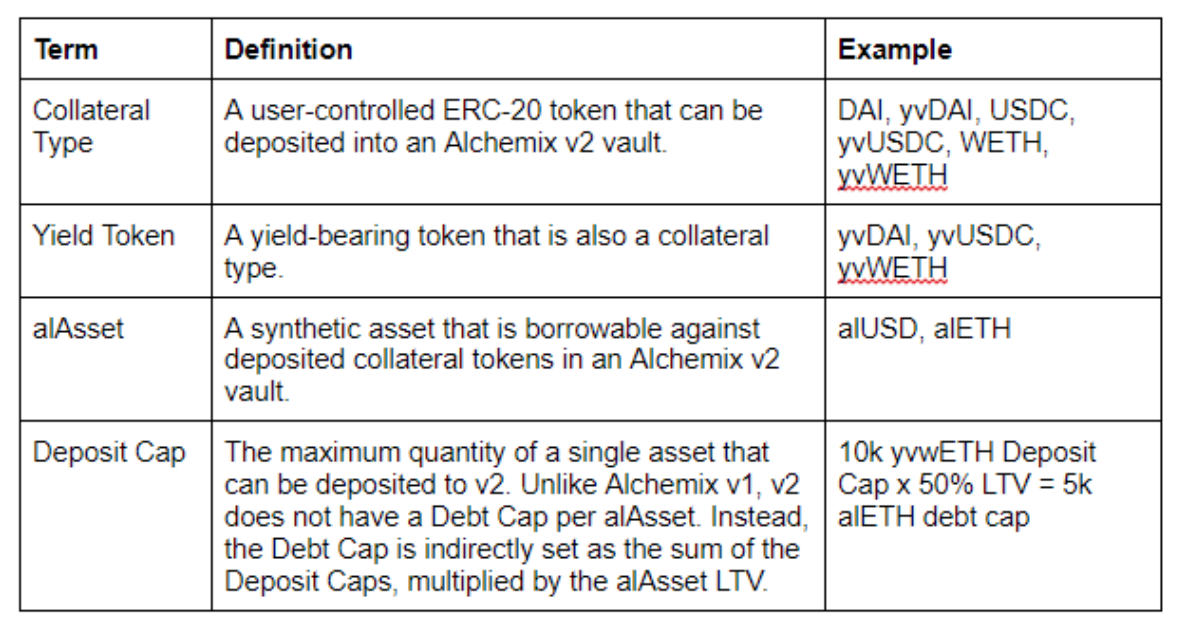

Glossary

This AIP must use some specific terminology to correctly identify the configuration items in the Alchemix v2 implementation.