I'm happy to see this come up as an evolution of the original proposal. There seemed to be a bit of unhappiness with the cuts to (g)ALCX in the first version, which I can understand.

In general, I wish we could integrate strategies like tALCX directly into the main ALCX staking pool. The gALCX wrapper offers great UX, but I think it's a shame that it just parks ~230k ALCX (at present) in a contract and allows it to sit idly as an unproductive resource. In contrast with the relatively limited utility of unproductive gALCX that's kept on mainnet, tALCX offers quite a bit more value to Alchemix. However, it has a bad UX and the existence of two single-sided staking pools causes an inefficient allocation of ALCX emissions because of the friction involved in switching between the pools. In any case, I'd love to see a scenario where the tALCX and (g)ALCX pools were effectively merged, such that DAO could vote on allocating x% of staked ALCX over to Tokemak (or other IL-shielded single-staking destinations) in order to accrue productive third-party assets, whilst also helping to boost liquidity wherever ALCX is needed.

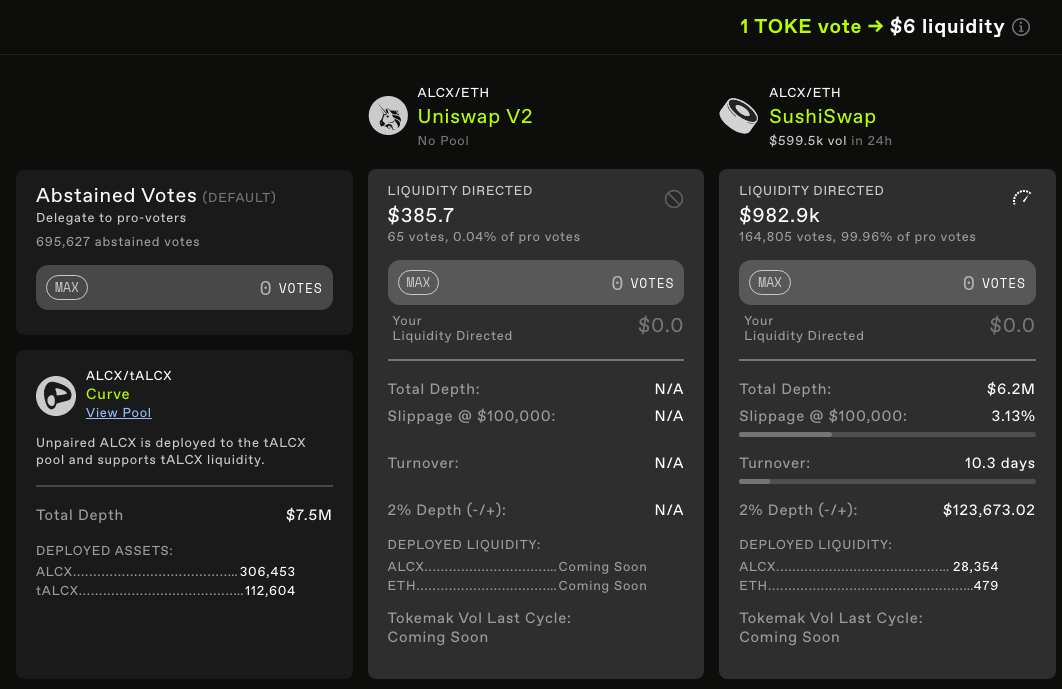

For reference, Tokemak currently holds ~450k ALCX, of which ~190k (~$1M) is deployed to the ALCX/ETH Sushi pool, accounting for about 16% of the total liquidity in the pool (~$6.24M). This is of course much lower than the total capacity that Tokemak could direct if it chose to do so, and their internal governors are responsible for artificially restricting that. I think we're all patiently-impatiently waiting for the day where they open up the throttle a bit more, and start to actually use more of the deposits that they have access to (...safely, of course).

It's also worth considering, again, that Alchemix does have ~$6M liquidity in its primary DEX pool, against an MCAP of ~$23M, so I do think there has to be an argument for re-evaluating the ALCX/ETH SLP staking emissions (i.e. to confirm whether 20% of emissions is still the right number), and I think that the liquidity provided by Tokemak could play a role in that discussion.

Above all, I do think it's important that we take action now, and it's plainly apparent to me that more emissions need to be redirected to the treasury so they can be spent more effectively during happier times. I really dislike the weird personality split between the tALCX and (g)ALCX pools and I've absolutely love to see a creative solution to that, but I'm not (quite) foolish enough to think that it's reasonable to expect a magical solution.