The last major update of the allocation of our weekly emissions schedule was done in May (AIP-9). Since then there have been a few updates in separate proposals, like a bribing allocation (AIP-18), the introduction of bonds (AIP-21), and tALCX staking (AIP-22). This AIP is to formalize the emissions allocation going forward in light of these new developments.

Taking into account that:

Bonds for ALCX/ETH have been very successful (>1.3m in protocol-owned liquidity at the time of writing).

New bonds of the alUSD and alETH pools are planned to be introduced.

Alchemix will get a Tokemak reactor for the ALCX/ETH pool (November/December).

Our bribing done through Votium have resulted in a high(er) APR% & TVL for both the alUSD and alETH Curve pools (the latter moving from 45m in TVL to 390m currently and after the gauge & bribes).

In short, all these actions have resulted in an increased TVL in the pools & more sustainable solutions for keeping liquidity (i.e. we won’t need to incentivize the pools as much, because we own/direct more liquidity in the future). As a result, it's time to rethink how we allocate our weekly emissions of ALCX.

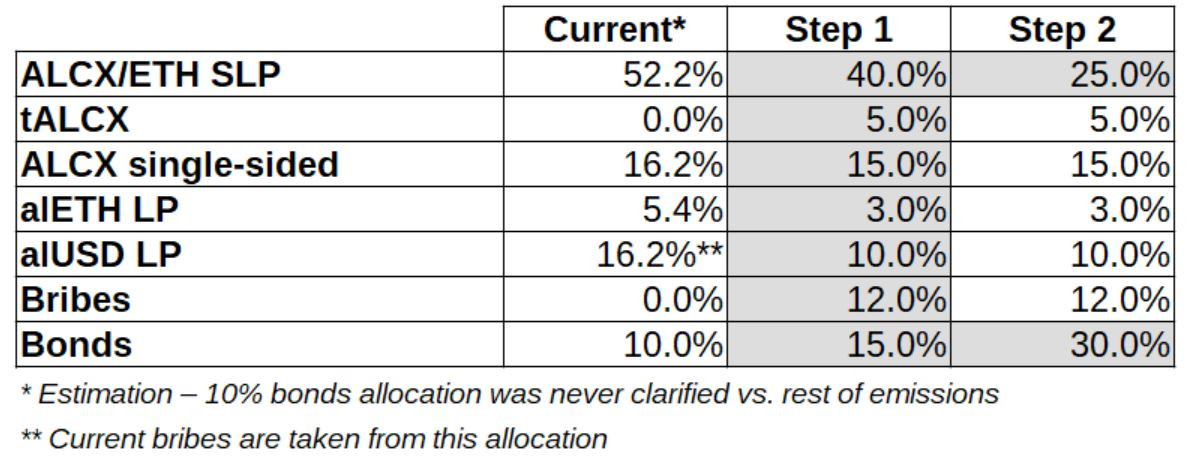

Through the comments on the draft version of this proposal and the discussion in the Discord thread (thanks for all the feedback!), this AIP would propose the following allocation – done in two steps.

Step 1 would be an immediate change which would allocate part of the emission to bribes (which are now taken from the alUSD LP), increase the bonding allocation to 15%, and tweak the rest of the numbers.

Step 2 would allocate an additional 15% from the SLP to bonding, bringing the total allocation of the latter to 30%. The timing of this step would be once the new bonds are introduced and ideally after the Tokemak reactor goes live. With this proposal, we would leave the exact timing of step 2 at the discretion of the core team.

ALCX/ETH SLP

This is the biggest change in allocations, going from roughly 52.2% today to 40% and then 25%. Please note that the 52.2% also includes the 5% tALCX allocation, so in reality the change would be 47.2% – 40% – 25%.

There are a few reasons for this: 1) We will get a Tokemak reactor for this trading pair, which will give us more sustainable liquidity. 2) We now own part of this pool ourselves through the bonding programme (>1.3m). 3) Looking at the current liquidity in the pool & daily trading volume I would argue that we are overpaying for what we need.

On the latter point, please look at the following trading pairs on Sushi (all taken from the Sushi analytics dashboard).

ALCX/ETH: 174m in liquidity / 4m in daily volume / 2.2% utilisation

SPELL/ETH: 66m in liquidity / 24m in daily volume / 36.8% utilisation

CVX/ETH: 106m in liquidity / 69m in daily volume / 65.0% utilisation

OHM/DAI: 244m in liquidity / 47.5m in daily volume / 19.4% utilisation

Obviously, the volume in these pools will depend very much on what is happening to these protocols and will have significant spikes upwards – however, in comparison to other trading pairs, the utilisation of the ALCX/ETH is quite low, while we are paying a significant amount for the liquidity in the pool.

tALCX staking

Introduced in AIP-22. Personally, I think this is a great way of getting more TOKE and thus being able to direct more liquidity to the ETH/ALCX pool in the future. I would propose to leave the 5% as is and update it later on if needed, depending on how successful this will be.

ALCX single-sided staking

Reduction from roughly 16.2% currently to 15%. Out of all the pools, this one probably has the lowest direct utility at the moment. However, it does lower the selling pressure & reward long-term holding of ALCX. I would propose to round it down to 15%.

alETH LP

From 5.4% currently – split equally between Saddle and Curve. The suggestion from Scoopy was to leave the 3% allocated to Saddle since the Curve pool will be boosted significantly by the bribes.

alUSD LP

Down from 16.2% today but worth noting here that our current bribes (400 ALCX/week) are taken out of this allocation. So in reality we are only removing a % for alUSD LPers. Again, they will be compensated with higher bribes, resulting in more CRV & CVX rewards.

Bribes

Our bribes for both Curve pools (through Votium) have been effective in attracting new liquidity (for alETH it went from roughly 45m initially to >390m at the time of writing). Considering we are currently bribing 400 ALCX per pool per biweekly window, the capital efficiency of bribing vs. direct LP incentivization is higher. For more info on TVL changes after bribing, Votium has published some data on Twitter, and llama.airforce is another good source to see the changes in TVL over time.

However, there is an increasing amount of competition for bribes so if we want to have the same results in the future we need to step up our game. The suggestion in this proposal would be to lower the ALCX rewards for LPers but to increase the bribes (and, as a result, the LPers will get less ALCX but more CRV and CVX - so a net win for them).

Another reason to allocate 12% of the emissions for bribing is the introduction of the d3 alliance, which – if it passes and receives a gauge – would need to get some bribing allocation in order to get the pool up and running. If this D3 proposal does not pass or does not receive a gauge, the percentage could be allocated to bribes for the existing two pools or send to the DAO for future use. This proposal would leave this to the discretion of the core team (noting, of course, that we don’t want to overpay vs. competitors when it comes to bribes - so if the allocation is not needed, let's not use it).

Worth noting here as well that we also benefit from our own bribes through 1) having CVX voting power (so we get to claim part of our own bribes), and 2) Having protocol-owned liquidity in the future results in more CRV/CVX rewards from these pools for ourselves.

Bonds

Our bonding programme has been successful in the pilot phase and I would suggest ramping this up significantly, going from 10% currently to 15% in step 1 and 30% in step 2. The reason for this step-wise update is that we only have one bond at the moment (ALCX/ETH SLP token) and so allocating 30% right away would be a significant expense. However, as soon as the two new bonds (alETH and alUSD LP tokens) come online we would be able to split the 30% allocation between the three.

Summary

A vote “for” this proposal results in the adoption of the above emissions framework & two-step implementation. A vote “against” would leave the current emissions allocation as-is.