Introduction

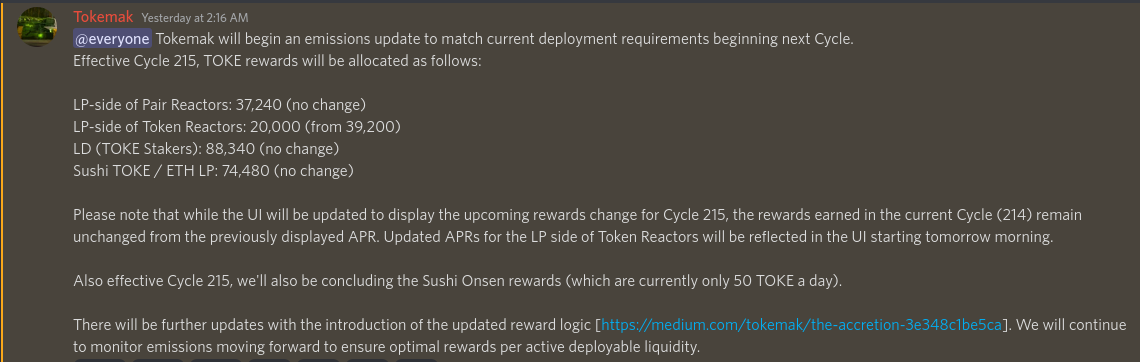

Since October 2021, Alchemix has incentivised tALCX stakers with a portion of ALCX emissions. Tokemak recently announced that the TOKE rewards allocated to tAsset holders (i.e. token reactor LPs) would be cut in half, and this change came into effect with the rollover to Cycle 215 on Wednesday the 1st of June.

In line with Alchemix’s sharpened focus on emissions utility, this AIP proproses to reduce the ALCX and tALCX staking pool emissions, and to double the amount of ALCX that the Alchemix treasury has directly staked in the ALCX token reactor. This will approximately offset the reduction in TOKE that Alchemix harvests from Tokemak and will support the initiative of AIP-49 to increase treasury CRV holdings, whilst simultaneously ensuring a better ROI on emissions to ALCX stakers.

General Comment

Reducing emissions allocated to the ALCX staking pools is understandably contentious. This is done with the objective of improving the utility of ALCX emissions. The exact numbers in this proposal are potentially subject to change based on feedback and discussion with the broader community.

tl;dr

Two changes are proposed:

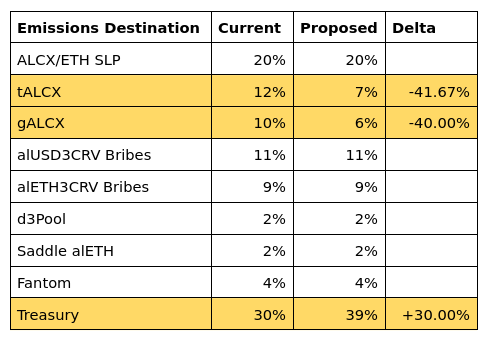

- Update the emissions allocation as follows, in two steps:

- Stake an additional 69,420 ALCX from the Alchemix treasury into the ALCX token reactor. For context, the treasury currently holds ~260k ALCX.

Rationale

Background

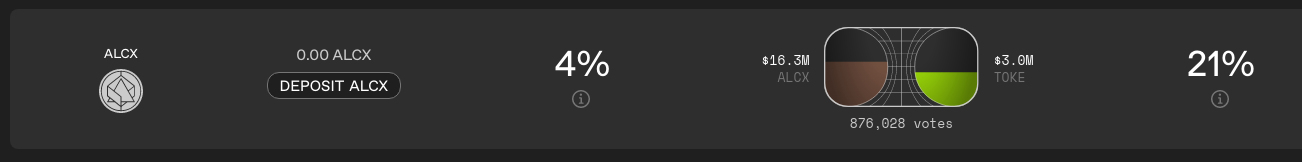

The specific prompt for this proposal is a recent update from Tokemak regarding their own TOKE emissions. As of cycle 215 (June 1st, 2022), Token Reactor LP emissions have fallen by almost 50% (from 39,200 TOKE/cycle to 20,000 TOKE/cycle). Tokemak currently projects an APR in the range of 4 - 5 % for the next reactor cycle. This is down from a steady state APR of about 9% from cycles 214 and earlier (note: this is based on many factors, including the market value of ALCX LPed to Tokemak, TOKE votes attributed to the ALCX reactor, and the balance of these in comparison with all other reactors).

How does this Tokemak stuff work anyway?

Tokemak’s rewards system has been explained at length on the Tokemak Medium and at Tokebase. An ALCX-specific explainer was also provided as part of AIP-32 Tokemak (War) Bonds.

In absence of reviewing the above material, the important thing to understand is that the Tokemak rewards system is reflexive, and that reactor rewards are currently determined predominantly based on the combination of LP-side ALCX TVL, and LD-side TOKE votes, with both measured in $ USD. When the ALCX price falls relative to other tokens with Token Reactors, it lowers the LP-side TVL and automatically reduces the TOKE payout for the next cycle. When users deposit or withdraw ALCX, this also impacts the TVL and the rewards are adjusted accordingly.

Impact on Alchemix

Alchemix sources TOKE via three primary sources:

- Voting rewards from staked TOKE.

- ALCX LP rewards from DAO-owned ALCX staked in Tokemak (currently 69,420 ALCX => ~$2.08M @ $30/ALCX).

- ALCX LP rewards from tALCX Staking Pool (~200k ALCX => ~$6M @ $30/ALCX).

This change has had a significant impact on the amount of TOKE that Alchemix is able to harvest via the two ALCX LP rewards sources. All other things being equal, these rewards have been cut in half.

Specifically with the tALCX staking pool, this change also implies that the emissions into that pool are now half as effective as they were before, because Alchemix is emitting the same amount of ALCX for 50% less TOKE.

An additional flow-on impact is that the effectiveness of AIP-49 will be reduced. For reference, this AIP approved the accrual of CRV with the TOKE harvested from the 69,420 ALCX staked directly by the Alchemix treasury (per AIP-32).

What do?

Part (1): Adjust Emissions to ALCX Staking Pools

Since the tALCX staking pool now produces half the anticipated TOKE, it’s worth considering a cut in the emissions to that pool.

The current ALCX emissions to the tALCX staking pool are set at 12%, corresponding to 1,668 ALCX in week 66 of ALCX emissions. There is currently 187k tALCX currently staked in the Alchemix staking pool. With a projected APR of 5%, a TOKE price at $3.3 and an ALCX price at $30, this produces a yield of 1,600 TOKE/cycle, at a market value of ~$5,400. Meanwhile, the market value of these ALCX emissions amounts to ~$50k, meaning Alchemix is arguably paying a ~9x premium to accrue this TOKE (the benefit of tALCX being a no-loss token sink for ALCX notwithstanding).

Given this reduction in TOKE rewards, it now seems clear that Alchemix is over-allocating ALCX rewards to the tALCX pool. The obvious reaction is to cut emissions to this pool in half to correspond to the Tokemak change. However, it’s worth considering the following points:

Both the (g)ALCX and tALCX staking pools act as a sink, accounting for ~200k ALCX and ~187k tALCX respectively:

(a) At present, the majority of (g)ALCX staking pool emissions work to incentivise holding of ALCX, thereby offering stakers some relief against ALCX debasement via emissions.

(b) A subset of these emissions are actually incentivising liquidity on Fantom via the gALCX wrapper, and this will extend to additional chains (Arbitrum, ...) as Alchemix expands its reach.

TOKE obtained via tALCX staking can be farmed, whereas idle ALCX in the treasury can not.

The large stack of TOKE held by Alchemix can be strategically useful - for example, see the summary of the Alchemix C.o.R.E.3 voting round.

The ALCX emissions schedule is fixed, and this ALCX needs to go somewhere. What is within control of the DAO is where the emissions are directed.

Therefore, this AIP proposes to reduce emissions to the tALCX pool by ~41.6%, from 12% of emissions to 7%. This change should be made in two steps in order to allow for an orderly exit from the pool (and potentially from ALCX) for those who wish to do so.

At this time it also makes sense to consider the emissions to the (g)ALCX pool, so as to mitigate any unintentional rotation from tALCX into gALCX. The tALCX pool has always commanded a premium in order to compensate stakers for the additional benefit to Alchemix, plus the additional overheads involved in staking in the tALCX pool, as well as the implicit additional smart contract risk from routing ALCX via Tokemak. In contrast, the (g)ALCX pool serves mostly to help normal holders to experience relatively less ALCX debasement, whilst also helping to incentivise non-Ethereum liquidity for Alchemix (currently limited to Fantom, with Arbitrum and other deployments on the way).

The addition of the gALCX wrapper has already delivered a significant gas optimisation to stakers, offering hyper-frequent compounding and eliminating the need to manually stake. Additionally, it’s important to recognise that AIP-49 (pausing Olympus Pro bonds and redirecting 30% of emissions to treasury) has significantly reduced the amount of short term debasement experienced by ALCX holders. The existing emissions to the (g)ALCX pool are set at 10%. It is therefore additionally proposed to reduce (g)ALCX pool emissions to 6% in two steps.

Any potential further reductions in emissions percentages to the tALCX and (g)ALCX pools would be considered as part of future AIPs.

Part (2): Redirecting treasury ALCX to Tokemak

Part (1) of this AIP proposes to reduce ALCX emissions to the tALCX and (g)ALCX staking pools, such that the amount sent to treasury increases from 30% to 39% (corresponding to 5,370 ALCX/week in week 67 of the emissions schedule).

All other things being equal, the redirection of emissions should lead to relatively less ongoing selling pressure, thereby reinforcing the effectiveness of the remaining emissions. However, this ALCX would be redirected to the Alchemix treasury, where it would sit idle as an unproductive asset.

Per AIP-32, 69,420 ALCX was previously parked in the ALCX token reactor, permitting Alchemix to boost its regular TOKE harvest and deliver an additional benefit to ALCX LD voters. In order to revert to the reward structure from before Tokemak cycle 215 Alchemix would need to double its stake in the reactor. Therefore, this AIP proposes to deposit an additional 69,420 of Alchemix treasury ALCX into the ALCX token reactor.

This additional 69,420 ALCX would effectively be replaced by ongoing redirected ALCX emissions, requiring only ~14 weeks @ 39% of total emissions before the amount would be recouped. This should reinstate the LP-side TOKE harvest, and per the reflexive nature of Tokemak rewards, should also deliver a lesser flow-on benefit to the LD-side TOKE voters. Note: Admittedly, Tokemak have indicated that this reflexive benefit to LD voters has a limited lifespan.

This sucks…why did our Tokemak friends do this?

From the perspective of a (t,g)ALCX staker, this change by Tokemak might seem unfortunate because of the impact rippling through to Alchemix staking emissions. Considering this situation from the Tokemak perspective, it’s apparent that the change is intended to improve the effectiveness of their own TOKE emissions, and it’s hard to blame Tokemak for that.

It’s also worth noting that Alchemix has significant TOKE holdings (over 200k TOKE), and the value of these holdings has fallen significantly over the past months. Alchemix is therefore strategically aligned with Tokemak in its interest to see an improvement in the TOKE price. It should therefore be apparent that ALCX holders who are aligned with the long-term Alchemix vision would similarly see an advantage to reversing the recent TOKE price action.

Looking Forward

With AIP-49 already implemented, the impact of enacting this AIP would mean that 39% of total emissions are redirected to the Alchemix treasury. This should implicitly result in less dumping of ALCX onto the market, thereby reducing downwards pressure on ALCX itself, as well as Impermanent Loss on ALCX LPs. The Sushi ALCX/ETH pool currently consumes 20% of ALCX emissions, with the one of the justifications being that these LPs are providing a critical service for Alchemix and are prone to wearing so much IL. If the IL experienced by LPs is reduced, it potentially opens the door for a re-evaluation of the 20% emissions to LPs in a future proposal.